Money is very much a part of our daily lives. Sure, we all have various levels of income and expenses, but at the end of the day, we all use money and need it, in some measure, to get by. It has practically become a part of nature for us to make payments by card, cash, coins or check, and we don’t even think about it. But, how did we get here? Follow us as we take a look at how the monetary system came to be, by following the footsteps through time to where it all began! Let’s find out the origins and evolution of currency!

The Barter System Before Money

Wealth is not necessarily only monetary, as we also view people with many possessions as wealthy, like those with large numbers of livestock. Money is actually one of the most significant and one of the earliest inventions of civilizations. Currency is an essential element in trade development. Without money, the remaining means of trade is the barter system, which develops between two people who each possesses something the other desires. This barter system is the root of our monetary system. In this system, if you desire something, you require something to exchange with the person who has what you desire, and so it is quite limiting and complex.

The Shell System

An often quoted example of a form of primitive payment system is the use of shells. Cowrie shells were commonly used in Africa and their equivalent in America were the wampum shell beads. The cowrie shells came from the Indian Ocean, on the Maldive Islands, and were a treasured item in Indian and Chinese civilizations of ancient times. The shells traveled the trade route from India to Africa. The American Indians hand-fashioned shell beads from the whelk shell and these beads were called ‘wampum’ by Europeans. Both these shells became a conventional currency, enabling people the flexibility of choosing when they would like to go shopping for items.

Commercial Currency & Trade

In terms of commercial transactions, the earliest currency used for this purpose appeared in Mesopotamia and Egypt in the third millennium BC. The currency consisted of gold bars, which were weighed in order to establish their value whenever they were exchanged. Later, to supplement the system for smaller sums, the use of gold rings was added to the system. By 2,500 BC, extensive trade took place based on the exchange of silver and gold in what is today Syria. Gold rings and ornaments were easily worn for safekeeping and even today in some parts of the world, like India, poor people wear their wealth this way.

Keeping Your Wealth Safe in a Sacred Place

While trade was certainly improved when the system of using gold was introduced, the convenience did come with a drawback – gold was easily stolen. A temple was the solution in early civilizations for a safe place of refuge as it was a solid building and constantly visited. The sacred character of the building was also believed to help deter rogues. Gold was deposited in these buildings in Mesopotamia and in Egypt for safe keeping. Then, while the gold laid idle there and others needed to trade in the community, the concept of loans came about in the 18th century BC, in Babylon during the times of Hammurabi.

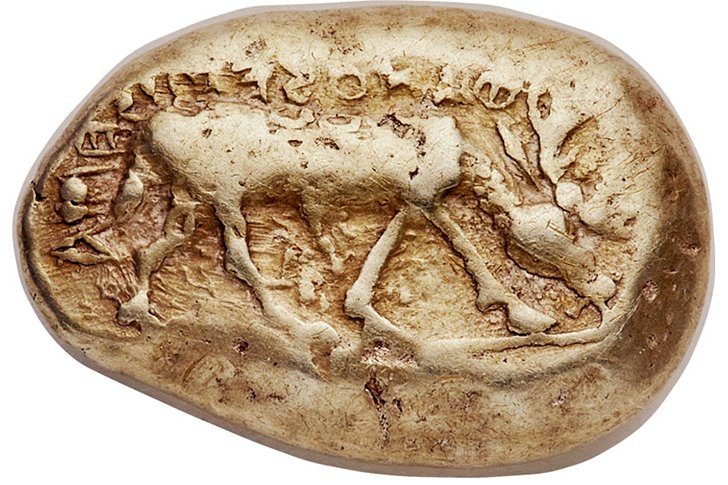

The Early Coins of the Western World

The earliest coins in the West to have been discovered were from the city of Ionia, called Ephesus, which is known in the present day as Western Turkey. The coins were in use at about 650 BC, made from a metal called electrum, which is a natural gold and silver alloy found in the local region. The coins were not circular but rather, kidney-shaped and with the image of a lion on one side. The purpose was to ensure a standard value in the metal as it was previously traded by weight. The coins are a mix of about 45% silver and 55% gold.

Pure Metal Coins Come Into Fashion

Approximately one hundred years later, King Croesus, of the neighboring land, Lydia, became the first ruler to forge coins not from alloys, but rather, from pure silver and pure gold. King Croesus was famed for his wealth and so it was quite apt that he developed these pure coins. Croesus’ coins were also stamped on one side with the heads of the bull and the lion facing each other. The Greek cities that lay to the west of Lydia and also the Persian Empire to the east quickly adopted the currency developed by Croesus, and it so happened that by the end of the 6th century, the coinage had become common throughout the area.

The Backward Romans Are Busy Developing A Currency

In the same space of time, the distant Romans were trading in a more backward currency, using unworked bronze lumps as a form of currency for trading. The value of the Roman currency was expressed in terms of livestock - referring to sheep and cattle. This concept was reflected in the term ‘pecuniary,' in the languages that were influenced by Latin because the Roman word for money was ‘pecunia’ which was derived from the word for cattle or ‘pecus.' And so, the Romans were also in the midst of the development of their currency, albeit far behind the metal stamped coinage.

China Moulds Their Coins Between 7th - 3rd Century BC

Strangely enough, while those in Ephesus were striking their precious metals (gold and silver) in Asia Minor, there were China’s skilled casters minting their coins by a very different method. The casters poured molten bronze into coin molds to mint their elaborately shaped coins. The coins of China did not resemble those of Ephesus, as China’s were made in two characteristic forms – one resembling the metal of a spade, and the other a knife blade with a handle. Both coins were decorated with elaborate Chinese characters. This continued until Shi Huangdi came along, pictured above.

Shi Huangdi Introduces A More Fashionable Coin

Shi Huangdi was China’s first emperor, and he introduced a coin different from the one that China had been using before his reign. Shi Huangdi introduced a coin that more closely resembled the coins of today – round in shape. The round coin was developed by the end of the 3rd century BC and was also still cast in molds and from bronze like the previous coins, but they featured a square hole in the middle. These round coins with square holes became a characteristic shape for coins of the Far East for the next two millennia.

The Greeks & The Romans Develop Banking Systems By 4th Century BC

From the 4th century BC, the banking activities in Greece had become more sophisticated and varied than in all previous societies. There were temples, public bodies, and private entrepreneurs who undertook financial transactions. The system was much like that of the financial institutions we know today, as they allowed people to borrow funds, took deposits, exchanged cash across currencies, engaged in book transactions, and even tested the coins for their purity and their weight. There was even the concept of credit, where lenders would accept payment in one city and arrange for the credit in another, avoiding the transfer of large amounts of coins. Rome adopted these banking practices from Greece.

From the 4th century BC, the banking activities in Greece had become more sophisticated and varied than in all previous societies. There were temples, public bodies, and private entrepreneurs who undertook financial transactions. The system was much like that of the financial institutions we know today, as they allowed people to borrow funds, took deposits, exchanged cash across currencies, engaged in book transactions, and even tested the coins for their purity and their weight. There was even the concept of credit, where lenders would accept payment in one city and arrange for the credit in another, avoiding the transfer of large amounts of coins. Rome adopted these banking practices from Greece.

The Byzantine Solidus Becomes the Root of Today's Dollar in the 7th - 16th Century

The versions of coinage in Rome during the Middle Ages were the roots of some of the units of currency that are used today. These Roman originals were minted between the 7th and the 16th century. The Byzantine empire had a stable currency, a gold coin, called the solidus, which would later be linked with the various forms of the European shilling. It was later joined with another gold coin called the dinar as a hard currency. The dinar was from the Latin word ‘denarius’ and was first minted in 690 by the ninth caliph of the Arab Empire, Abd-al-Malik of Damascus.

The versions of coinage in Rome during the Middle Ages were the roots of some of the units of currency that are used today. These Roman originals were minted between the 7th and the 16th century. The Byzantine empire had a stable currency, a gold coin, called the solidus, which would later be linked with the various forms of the European shilling. It was later joined with another gold coin called the dinar as a hard currency. The dinar was from the Latin word ‘denarius’ and was first minted in 690 by the ninth caliph of the Arab Empire, Abd-al-Malik of Damascus.

A Popular European Coin Is Born

In around 755, there came the introduction of the silver denarius, by Frankish King Pepin III, who went by the moniker Pepin the Short. In French, the silver denarius coin was called a denier and in English, a penny. This coin became the most common currency in Europe – it was basically the standard medieval coin of Western Europe until the 13th or 14th century. The kings of the Carolingian dynasty later came to standardize the ‘penny’ and decreed that 240 of them would be struck out of a pound of silver. Textbooks would also show that twelve silver pennies were also established to be worth as much as the Byzantine gold solidus.

The Penny: Shilling: Pound Relationship Is Born

The Byzantine gold solidus whose value was equivalent to twelve silver pennies was also called the shilling. The monetary scale of 1:12:20 then evolved, with one penny, 12 pennies to a shilling, and 20 shillings (or Byzantine gold solidus) to a pound. This system prevailed in Europe for a long time, right until the decimalizing French Revolution innovation, and it also prevailed in Britain until 1971. The pound was actually at first a measure of weight and not money, with the Byzantine gold coin simply a yardstick of value. The shillings and pounds earned value in their own right in the system.

The Byzantine gold solidus whose value was equivalent to twelve silver pennies was also called the shilling. The monetary scale of 1:12:20 then evolved, with one penny, 12 pennies to a shilling, and 20 shillings (or Byzantine gold solidus) to a pound. This system prevailed in Europe for a long time, right until the decimalizing French Revolution innovation, and it also prevailed in Britain until 1971. The pound was actually at first a measure of weight and not money, with the Byzantine gold coin simply a yardstick of value. The shillings and pounds earned value in their own right in the system.

A Widely Respected Coin & A Widely Respected Bank

After that, the coins which had a lasting resonance were the Venetian ducats, which were initially minted back in 1284. The famous ‘golden florin’, or the "Fiorino d'oro" of Florence was launched in 1252. The coin was widely respected and it bore the name of the city itself, rather proudly if we say so. The coin became a significant factor in the banking success of Florence. Later, the financial institution by the name of the Medici Bank, by the Medici family of Italy, would become the largest and most respected bank in all of Europe. It was founded in the 15th century and was in prominence between 1397 and 1494.

After that, the coins which had a lasting resonance were the Venetian ducats, which were initially minted back in 1284. The famous ‘golden florin’, or the "Fiorino d'oro" of Florence was launched in 1252. The coin was widely respected and it bore the name of the city itself, rather proudly if we say so. The coin became a significant factor in the banking success of Florence. Later, the financial institution by the name of the Medici Bank, by the Medici family of Italy, would become the largest and most respected bank in all of Europe. It was founded in the 15th century and was in prominence between 1397 and 1494.

The Dollar Takes Root

Undoubtedly, the dollar became one of the most resonant of the currencies, and it originated from an old and larger silver coin called the Joachimsthaler – or Thaler for short. The coin was minted in 1518 from silver mined in a town by the name of Joachimsthal in the Kingdom of Bohemia, which is known now as the Czech Republic. As books would tell us, the name ‘dollar’ actually means ‘thaler,' and in Bulgaria and Romania, the name ‘lev’ and ‘leu’ are contractions of ‘lowenthaler.' In Slovenia, the ‘tolar’ is also a reference to the coin.

China Introduces Paper Money Between 10th - 15th Century

Paper fabrication was finding its footing during the Han Dynasty, between 206 BC – 220 AD, and with China manufacturing paper, it was only a matter of time until they produced paper money. This came to be, with the beginnings taking root at the end of the Tang period, where the Treasury exchanged metallic money for compensation notes called ‘Feythsian,' or flying money. In the Song Dynasty between 960 and 1276, there was a shortage of copper money and private drafts by the monetary reserve were the first notes that circulated as legal tender. By the time of the Yuan Dynasty between 1279 and 1367, paper money became the only legal tender.

Paper fabrication was finding its footing during the Han Dynasty, between 206 BC – 220 AD, and with China manufacturing paper, it was only a matter of time until they produced paper money. This came to be, with the beginnings taking root at the end of the Tang period, where the Treasury exchanged metallic money for compensation notes called ‘Feythsian,' or flying money. In the Song Dynasty between 960 and 1276, there was a shortage of copper money and private drafts by the monetary reserve were the first notes that circulated as legal tender. By the time of the Yuan Dynasty between 1279 and 1367, paper money became the only legal tender.

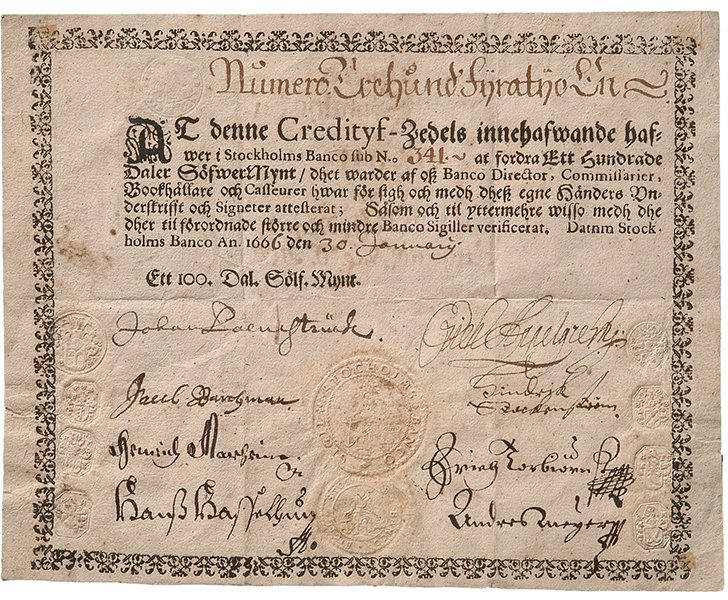

Bank Notes Try To Gain the Confidence of the Public Between 1661-1821

In the 17th century, Europe introduced paper currency in its monetary system. It was in 1656 that Johan Palmstruch established the Stockholm Banco, a private bank with strong links to the State as half the profits were payable to the royal exchequer. During a consultation with the government in 1661, Johan Palmstruch issued credit notes that were to be exchanged at his private bank for a specific number of silver coins. The notes were impressive pieces of paper with eight handwritten signatures printed on each. Unfortunately, he issued more notes than his bank could afford to pay out and by 1667, he faced the death penalty for fraud.

In the 17th century, Europe introduced paper currency in its monetary system. It was in 1656 that Johan Palmstruch established the Stockholm Banco, a private bank with strong links to the State as half the profits were payable to the royal exchequer. During a consultation with the government in 1661, Johan Palmstruch issued credit notes that were to be exchanged at his private bank for a specific number of silver coins. The notes were impressive pieces of paper with eight handwritten signatures printed on each. Unfortunately, he issued more notes than his bank could afford to pay out and by 1667, he faced the death penalty for fraud.

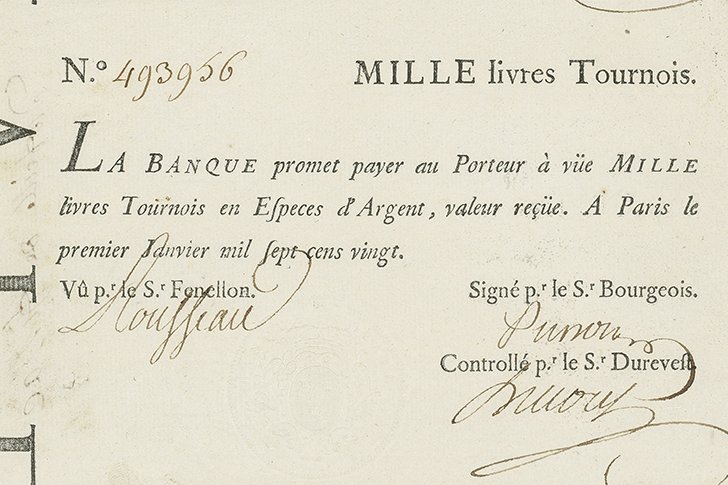

Bank Notes Strike Again!

After Palmstruch’s misfortune with the bank notes, half a century would pass before a far-sighted financier decided to take the risk and issue notes again in Europe. John Law was the name of the founder of the 1716 Banque Générale of Paris, and he issued bank notes from the first month of 1719. In 1720, the government halved the value of his notes, and the confidence of the public in his system faltered. However, the need to expand currency was recognized and throughout the 18th century, there was much experimentation with paper currency. Eventually, governments started issuing bank notes and the danger was not bankruptcy but this time, inflation.

The European Debase the Shell System Between 16th - 18th century

The 16th century was the age of European exploration, and this period led to very interesting encounters between the traders who were accustomed to traditional shell and precious ornament currency and those accustomed to coin and cash as currency. The Europeans were eager for trade with the regions in which there was no established coin system, and the trade resulted in immense inflation in both regions. The Europeans debased the shell currency when it was discovered they could flood the market with the shells. A machine was even invented in the 18th century to replicate the shell beads used as wampum by the Indian traders. They also imported shiploads of cowrie shells using British and Dutch ships.

Eager Investments in Latin American Mines Lead to Financial Crisis

In the 18th century, a financial panic broke out in America and in Europe after the over-investment in the South American mining firms. These speculative investments were also made into an imaginary country by the name of Poyais. The entire episode resulted in the stock-market crash in the Bank of England and the crisis was most acutely felt in Britain, where six financial institutions closed in London and six country banks closed in England. The Bank of England was saved from total collapse by an infusion of gold reserves from the Banque de France.

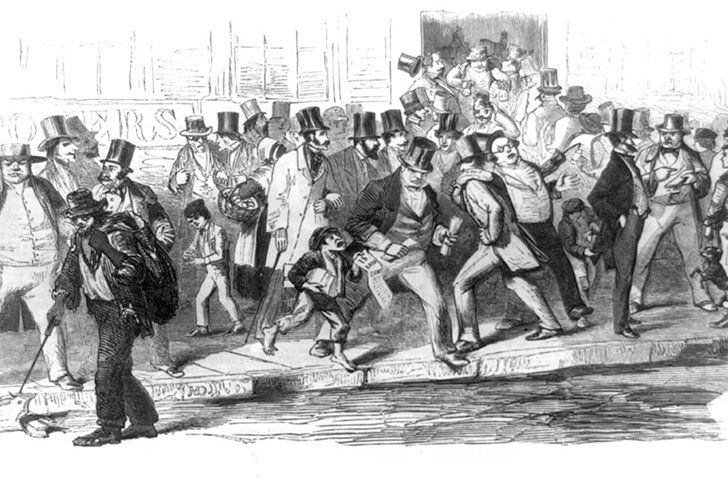

The Financial Panic of 1837 Kicks Off

The financial crisis of 1837 began with a great increase in the use of state bank notes for the payment of public land purchases, which alarmed President Jackson and led to him commanding that the Treasury no longer be allowed to accept the notes as payment for the sales. After he left office, there was a depression and there was no choice for the government but to borrow money. Over thirty percent of all bills at the time were fake, and over 700 banks could issue their own notes. Martin Van Buren was sworn in and he faced the financial crisis. The crisis lasted seven years.

After the $10 Eagle, the $20 Double Eagle Is Born

Before 1849, the largest denomination of the U.S. coin was the $10 eagle, and in 1849, the first ‘double eagle’ was minted. The double eagle was so called because it was worth $20, twice the value of the eagle. The $10 eagles were produced in 1795, so it was about time for a coin of larger value to come along! The first mint produced in proof resides in Washington D.C, in the Smithsonian Institution, while the second to be minted in proof was presented to William M. Meredith and was sold as part of his estate. However, the current location of the coin is unknown.

The Smallest Coin To Be Authorized for Minting in the U.S.

The smallest silver coin to be authorized for minting in the U.S. was the 3¢ piece, and the Congress authorized it in March of 1851. These pieces were referred to as 'trimes' and on the obverse side, they depicted a six-point star with a shield over it. It was supposedly authorized in order to facilitate the buying of 3-cent stamps and was issued between the years 1851 and 1873. The 1852 minted coins hold the record of the highest mintage for this type of coin, sitting at 18.6 million! That's a lot of money!

The First Worldwide Economic Crisis

The Panic of 1857 was sparked by the failing of the New York branch of the Ohio Life Insurance and Trust Co. and the crash was worsened by the speculation over the railroad securities and real estate securities. This was the first worldwide economic crisis, as the interconnectedness of the economy across the world had strengthened by the 1850s. The crisis was short-lived but the damage was extensive; recovery only began in 1861. The damage was great, especially because many merchants, banks, and farmers had taken up the opportunity to grow their investments, allowing themselves to take more risks than usual since the years immediately prior to the panic had been prosperous.

The Panic of 1857 was sparked by the failing of the New York branch of the Ohio Life Insurance and Trust Co. and the crash was worsened by the speculation over the railroad securities and real estate securities. This was the first worldwide economic crisis, as the interconnectedness of the economy across the world had strengthened by the 1850s. The crisis was short-lived but the damage was extensive; recovery only began in 1861. The damage was great, especially because many merchants, banks, and farmers had taken up the opportunity to grow their investments, allowing themselves to take more risks than usual since the years immediately prior to the panic had been prosperous.

"In God, We Trust" Is Minted on the 2 Cent Coin

It was in 1864 that the phrase ‘In God We Trust’ was first minted onto a coin, and it was on the 2-cent piece authorized by the Congress. The phrase only appeared on paper currency far later, in 1957. In fact, it was later declared the national motto and President Eisenhower passed the legislation declaring so in 1956. The 2-cent coin was minted from 1864 until 1872 but continued in 1873 for collectors. James B. Longacre was the coin designer, and each year after its design, there was a decrease in its mintages because other minor coins grew more popular and so it was abolished by 1873.

It was in 1864 that the phrase ‘In God We Trust’ was first minted onto a coin, and it was on the 2-cent piece authorized by the Congress. The phrase only appeared on paper currency far later, in 1957. In fact, it was later declared the national motto and President Eisenhower passed the legislation declaring so in 1956. The 2-cent coin was minted from 1864 until 1872 but continued in 1873 for collectors. James B. Longacre was the coin designer, and each year after its design, there was a decrease in its mintages because other minor coins grew more popular and so it was abolished by 1873.

The Establishing & the Disbanding of the Latin Monetary Union

In the 19th century, a monetary system called the LMU (Latin Monetary Union) unified a number of European currencies into one currency that was allowed to be used in all the states that were a member of the union. This occurred at a time when most currencies were made from gold or silver. The LMU was founded in 1865 and by 1927, it disbanded. Coins were minted by the standards of the LMU, by countries who weren’t even members of the union. Eventually, the union weakened because members of the treaty pursued economic policies of their own.

In the 19th century, a monetary system called the LMU (Latin Monetary Union) unified a number of European currencies into one currency that was allowed to be used in all the states that were a member of the union. This occurred at a time when most currencies were made from gold or silver. The LMU was founded in 1865 and by 1927, it disbanded. Coins were minted by the standards of the LMU, by countries who weren’t even members of the union. Eventually, the union weakened because members of the treaty pursued economic policies of their own.

The Great Depression Arrives, Bringing the End of the Gold Standard

In the 1930s, the eruption of the Great Depression (aka economic depression) brought with it major alterations in currency and the period was actually recognized as the beginning of the end of the gold standard. First, the gold standard was revised, and this revision involved the confiscation of all individual holdings in gold and thus the increase in gold price. This essentially resulted in the devaluation of the paper currency representing the gold. By the time it reached the 1970s, it had become such that the dollar was totally delinked form gold.

Paper-Based Currency is A Fiat Currency

Paper money in the U.S. after 1971 was a fiat currency, meaning it was not backed by a tangible commodity but rather by the relationship between the stability of the government and the supply and demand. Before 1971, though, paper currency in the U.S. was actually backed by a specific amount of gold, dictated by the Federal Reserve. Now, the paper currency is valued and regulated by a central bank and the standard has brought with it eroding value, stagnant wages, and other problems, like unbridled monetary expansion, though it is supposedly regulated but complex.

The Future of Finances

The future of finances leans toward many different kinds of investments. While the popularity of investing in gold, precious metals, and other commodities are increasing, there is also a new breed of investment on the rise - digital currency. This comes in the form of digital assets that are designed to be used as an exchange medium. These currencies use decentralized control, unlike the central banking system. With them comes a whole new ball game, with blockchain serving as a public financial transaction database. Bitcoin was released in 2009 and is a decentralized digital currency whose popularity is on the rise.

The Fascinating History of Money

It sure is fascinating to look back on our forbears and learn how they went about their trading and acquired the things they required from others. It becomes clear when you look back on the history of money that it hasn’t actually been around for all that long and already we are moving on to new grounds with it, like digital currency. Things have changed a lot over the years and perhaps we should anticipate a lot more change to take place in the future. Countries like Sweden, China, and the U.K. are all in the race to see who will be the first cashless country. Let’s hop on the ride!